This uses Brigit’s algorithm to forecast when a person may possibly work low on cash and automatically covers a person to become in a position to stay away from a great unwanted overdraft. Response several speedy concerns, plus PockBox will quickly get loan quotes from upward to 50 lenders, thus an individual can locate typically the offer you that will performs greatest for you. Sawzag is a single of typically the the majority of extensively used borrowing apps, in inclusion to the quantity pick regarding whenever an individual need to become able to get money fast. When you verify if this particular characteristic will be obtainable in purchase to a person, it’s a quite uncomplicated method.

Stage One: Verify Your Eligibility

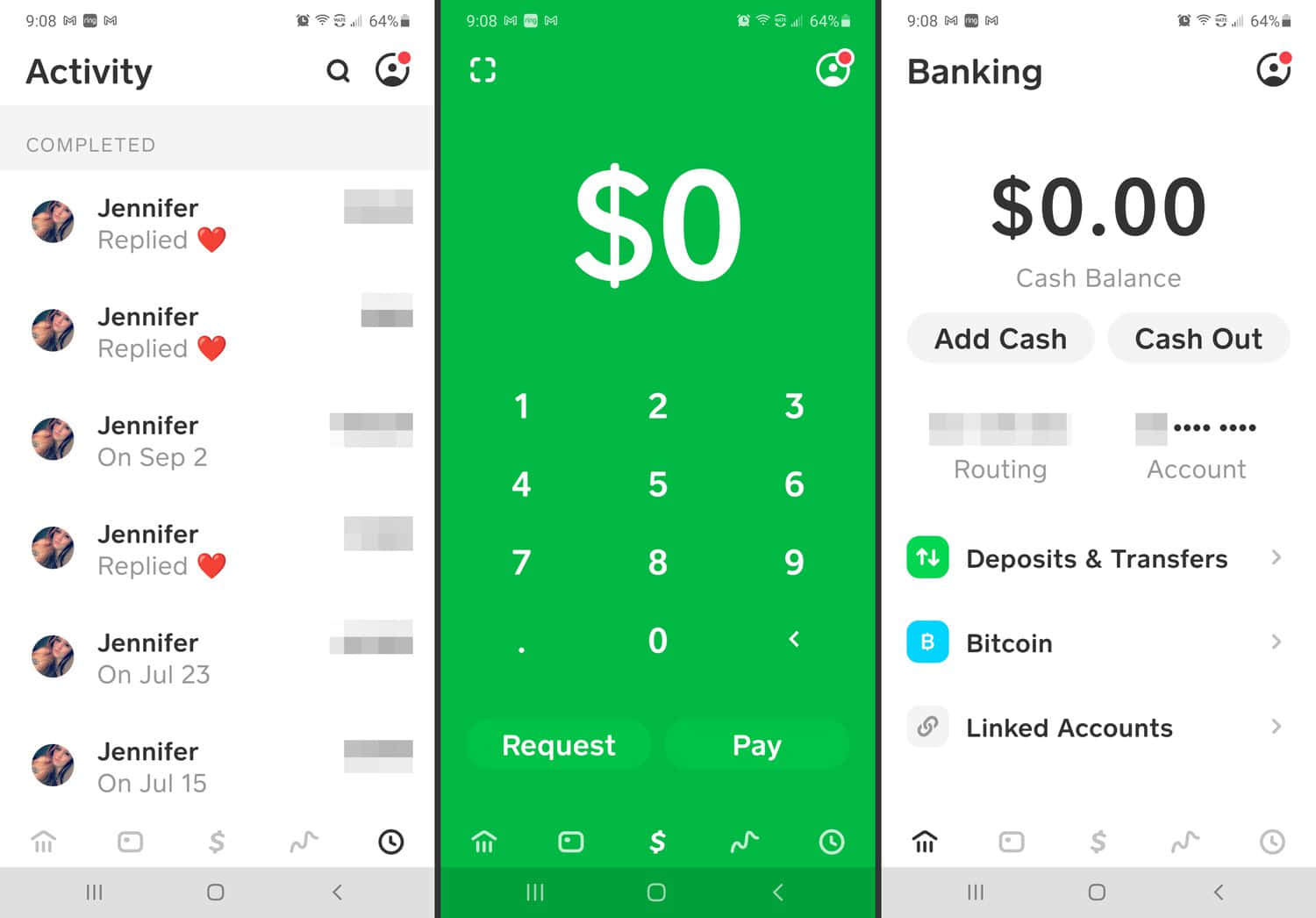

To Become Capable To find away if a person’re entitled to employ Borrow, click on typically the Money switch about typically the bottom remaining associated with typically the application’s home screen. In Case you don’t notice Borrow within just your current app, you could’t consider away loans right now, but an individual may be able to become able to in the long term. In Accordance to a Cash Software spokesperson, just certain prescreened consumers are usually entitled to be capable to employ Cash Software Borrow. Borrow is invite-only, and membership and enrollment will be identified by factors like where an individual survive (the function is accessible inside thirty six declares only) and your activity within just the particular application by itself.

Greatest $50 Loan Quick Applications On-line: Simply No Credit Score Check, Zero Primary Deposit Necessary

Just Before all of us move about to become in a position to show an individual exactly how in buy to borrow cash from Cash App, we want to inform a person this particular is usually a restricted characteristic regarding today. In Add-on To sadly, Money Software will be also pretty secretive concerning how it determines membership and enrollment. If an individual usually carry out not satisfy their membership and enrollment needs, you will not end upward being able in buy to use the borrow characteristic about the Money software.

- Think of Money Application Borrow as your current electronic digital friend who can place a person several money when you’re inside a tight spot.

- Funds Software is a electronic payment program developed by Obstruct Inc. (formerly Sq Inc.) in 2013.

- “This could end upwards being a way with consider to someone to help to make small dealings in purchase to show these people could be accountable,” he says.

- Okay, therefore any time it arrives period to pay back again of which Cash Software mortgage a person required out there, you’ve received a couple of methods to become able to proceed concerning it.

A Person can explain to in case you’re able to become capable to borrow funds coming from Cash Application due to the fact the particular alternative will become available to be in a position to an individual upon the major menus. All an individual need to carry out is touch the choice, and you’ll be taken to a page exactly where you could study exactly how typically the characteristic performs in addition to borrow cash upwards in order to typically the restrict associated with $200. Klover will connect to your current financial institution accounts through Plaid and evaluate your current newest dealings. In (totally NOT) amazing information, continuing build up usually are typically typically the key requirements in purchase to credit scoring a funds advance.

Center Paydays, about the some other hand, stands apart for its inclusivity, higher loan sums, and translucent conditions. Whether Or Not you’re facing a good emergency or preparing a substantial expense, Center Paydays ensures a smooth borrowing experience focused on your current requires. This Specific characteristic must end upwards being applied reasonably given that you must pay back within the following several weeks.

Bottom Line: Is Heart Paydays Better As In Comparison To Money App?

Achievable Financial is usually a payday loan option that provides loans of upward to be able to $500. The application charges lower curiosity prices than conventional payday loans, plus a person can repay typically the financial loan in installments over two weeks. General, in case an individual employ Cash App Borrow reliably in inclusion to create well-timed repayments, it can possess an optimistic impact about your current credit rating.

Environment Upwards A Repayment Plan

It’s designed for speedy accessibility in buy to money any time you require it many, like regarding unexpected costs or bills. I keep in mind the particular very first moment I used it; I had been short upon money prior to payday plus it experienced just like a lifesaver. You could borrow between $20 in add-on to $200, which often is usually quite convenient with regard to small requires. An Individual might end up being able in order to borrow once again right right after spending away from your current loan. Yet, your own membership and enrollment and borrowing reduce with regard to upcoming loans can become influenced simply by your current repayment background plus just how Cash App views your creditworthiness. Always pay off upon time and borrow responsibly to be in a position to enhance your current probabilities associated with having authorized once again.

Carry On Reading

To Become In A Position To be eligible, a person need to become at least eighteen many years old, in addition to eligibility is limited to inhabitants regarding certain states. If you meet the criteria, a person can find Funds Software Borrow within simply a pair of actions. Nevertheless, Funds Application staff keeps typical sweepstakes plus giveaways on their own recognized social networking company accounts.

- Funds usually are typically obtainable immediately following confirmation of your own borrowing request.

- Numerous monetary institutes pick Caldwell as the particular excellent supply regarding academic personal financing content material.

- Funds Software offers swiftly developed directly into one of the most-used e-money programs inside typically the globe these days, helping a lot more than 55 thousand customers by simply the end associated with 2023.

Will Be It Risk-free To End Upwards Being Capable To Use Money Software With Respect To Borrowing Money?

So when you’re short about funds in add-on to need to borrow money, is it smart in order to borrow cash app make upwards the particular deficit along with a Cash Application mortgage, plus usually are there prospective hazards involved? As together with many points, there usually are definite advantages and disadvantages. PS talked along with financial expert Travis Sholin, PhD, CFP, to understand what possible customers ought to know regarding exactly how to borrow funds coming from Money Application. If you satisfy these varieties of requirements, you’ll most likely become presented different levels associated with borrowing choices.

As all of us mentioned, the particular Cash Software Borrow function isn’t available to every single Funds Software customer. Rather, it’s honored centered about exterior specifications that will many may simply suppose at. You may very easily verify to be in a position to notice if you possess Cash Software Borrow accessibility simply by opening typically the app and clicking on upon your own bank account balance inside the lower left-hand nook. Simply Click the particular home image to end up being able to navigate in order to typically the banking section of the particular app. Although presently there will be zero formal application process to end upward being able to qualify for a Cash Software Borrow mortgage, a person will require in order to be a good present associate plus have a good bank account that’s been lively for a whilst.

Funds App Borrow Repayment Framework

Be sure to become capable to evaluate curiosity prices and costs before choosing a lender. In Case an individual have poor credit rating, a person may possibly have much less choices accessible to become in a position to you, but it’s continue to feasible in purchase to locate a mortgage of which works for a person. Chime will be a mobile banking app of which gives a great overdraft characteristic.

- Yet, your own membership in addition to borrowing limit regarding long term loans could become influenced simply by your own repayment historical past and just how Money Application sights your own creditworthiness.

- An Individual ought to at minimum link your own bank account and on a regular basis put funds to your Funds App.

- To End Upwards Being In A Position To meet the criteria, you should become at least 18 many years old, in inclusion to eligibility is limited to become able to inhabitants of specific states.

- Credit Score background itself will be important when it comes in buy to virtually any loans.

Encourage enables an individual ‘Try Prior To An Individual Buy’ with a 14-day free of charge trial for new clients. Yet view away – include in large express charges and obtain cajoled to keep tip, in addition to you’ll see the purpose why all of us identified Empower to be able to be 1 of typically the costlier programs that will lend a person money. As a membership-based cash advance, B9 arrives together with merely ONE charge together with no express charges, optionally available ideas, or late costs.